How Tax Reform under the Tax Cuts and Jobs Act Impacts You – The Latest by Edward N. Cooper, CPA

Posted on December 26, 2017

by

Edward Cooper

On Dec. 22, 2017, President Donald Trump signed into law the Tax Cuts and Jobs Act, which represent the most comprehensive legislation reforming the U.S. tax code in more than three decades. The new law, which went into effect on Jan. 1, 2018, makes permanent many provisions affecting businesses while setting a Dec. 31, 2025, expiration date for many of the tax cuts affecting individual taxpayers. While individuals may feel some effects of the reform package in 2018, such as less taxes taken from their paychecks, they will not reflect the full impact of the legislative changes until they file their tax returns in 2019.

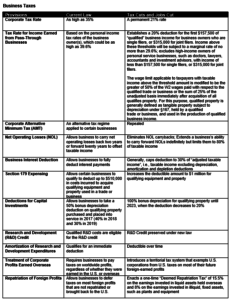

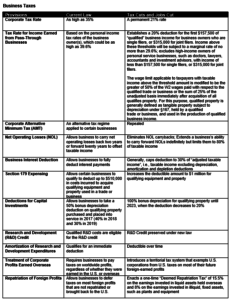

These sweeping changes to the tax laws provide opportunities for all taxpayers to reconsider their business structures, tax accounting methods and reporting positions in order maximize the opportunities afforded to them beginning in 2018 under the new act. For example, one of the more talked about strategies is the potential for certain pass-through businesses to convert to C Corporation status in order to take advantage of the lower corporate rates that go into effect and become permanent beginning in 2018. These decisions require careful analysis, and possibly further clarification of the new law, in order to fully maximize opportunity and avoid pitfalls.

While there is no lack of news coverage debating the prospective “winners” and “losers” of the reform package, individuals and business owners should consult with their tax advisors to understand not only how the law may affect them but to also plan for maintaining tax efficiency and compliance under the new regime.

The tax advisors with Berkowitz Pollack Brant are working closely with clients to evaluate their existing business structures, project out future tax liabilities under alternative scenarios and recommend potential changes to their business structures, reporting positions and operational policies and procedures.

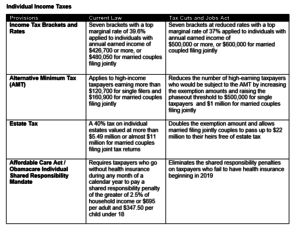

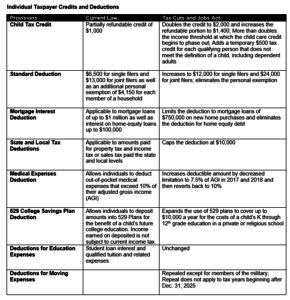

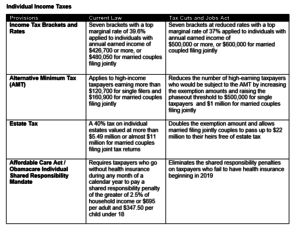

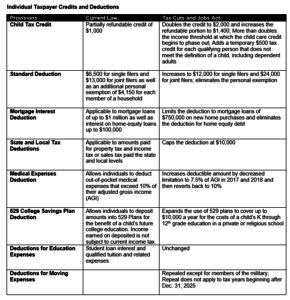

Following are the key provisions contained in the Tax Cuts and Jobs Act. If you have any questions, please contact your accountants and advisors with Berkowitz Pollack Brant.

About the Author: Edward N. Cooper, CPA, is director-in-charge of Tax Services with Berkowitz Pollack Brant, where he provides business- and tax-consulting services to real estate entities, multi-national companies, investment funds and high-net-worth individuals. He can be reached at the CPA firm’s Ft. Lauderdale, Fla., office at (954) 712-7000 or via email at info@bpbcpa.com.

← Previous