Current Guidelines for Retaining Tax Documents by Adam Cohen, CPA

Posted on April 24, 2023

by

Adam Cohen

After filing your federal income tax return, you will likely be left with a significant stack of legal and financial documents. Don’t throw them away. You will need them in the event your return becomes the subject of an IRS audit. Here’s everything you need to know about document retention and how to protect yourself if the IRS comes knocking.

The IRS can audit tax returns filed within the previous three years and go back six years when it identifies a substantial error, such as a 25 percent or more underestimate of the gross income reported on your return. Therefore, it is a good idea to hold onto previously filed tax returns, including proof of income and deductions, for a minimum of six years. However, be advised that if you failed to file a tax return or willfully filed a fraudulent return, the statute of limitations may never run out; the IRS can go after you for civil and criminal tax fraud at any time.

In general, it is advisable to hold on to legal and financial documents for as long as they are in effect and you are responsible for making payments. For example, keep all documentation for insurance policies and retirement accounts indefinitely. By contrast, documents related to the purchase, finance or improvement of real estate should be held during all the years you own the property and an additional three years after a property sale. The same is true for records of stock and other investment purchases and sales, for which you will need to demonstrate your original basis in the assets and the fair market value of the date of sale. Documents relating to student loans, mortgages, alimony and child support should be retained until you fulfill all your financial obligations under those agreements.

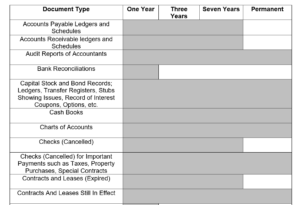

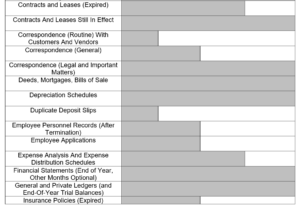

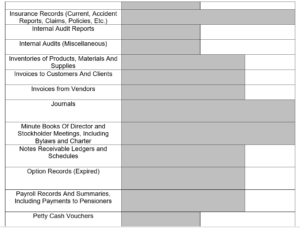

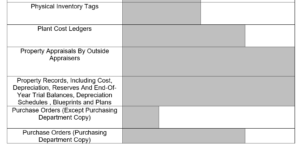

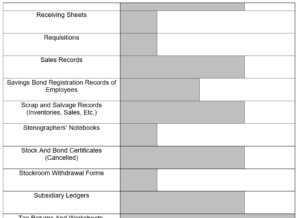

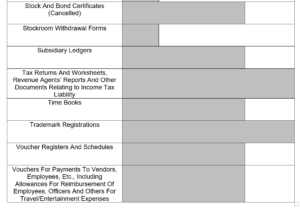

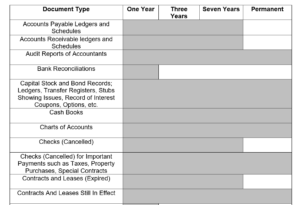

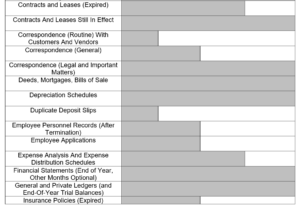

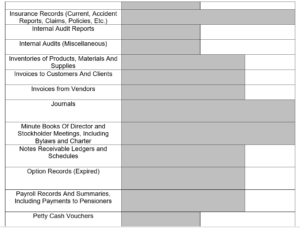

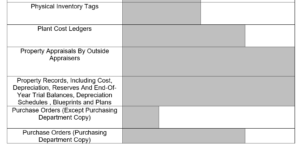

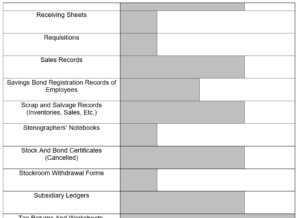

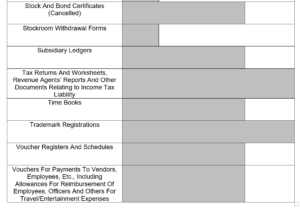

As you can see, there are no hard-and-fast rules for how long you should keep tax records. However, you can minimize your record-keeping burden by considering the guidelines in the chart below. On a final note, when it comes to discarding tax documents that contain your personal information, it is a good practice to shred them to protect yourself from potential identity theft and other forms of fraud.

About the Author: Adam Cohen, CPA, is an associate director of Tax Services with Berkowitz Pollack Brant Advisors + CPAs, where he works with closely held businesses and non-profit charities, hospitals and family foundations to maintain tax efficiency and comply with federal and state regulations. He can be reached at the CPA firm’s Ft. Lauderdale office at (954) 712-7000 or info@bpbcpa.com.

Information contained in this article is subject to change based on further interpretation of tax laws and subsequent guidance issued by the Internal Revenue Service.

← Previous