Significant Findings and Considerations from the ACFE 2023 Benchmark Report on Combatting Business-to-Business Fraud by Richard S. Fechter, JD, CFE, CAMS

The Association of Certified Fraud Examiners (ACFE) and Thomson Reuters partnered to explore the risks and controls related to business-to-business transactions and relationships. Specifically, the 2023 “Combatting Business-to-Business Fraud: Benchmarking Report” focuses on the risks associated with doing business with new vendors and the use of “know-your-vendor” (KYV) and “know-your-business” (KYB) processes to minimize those risks.

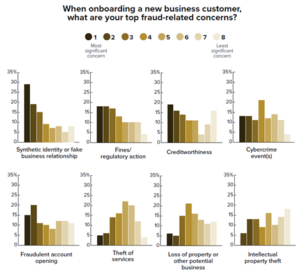

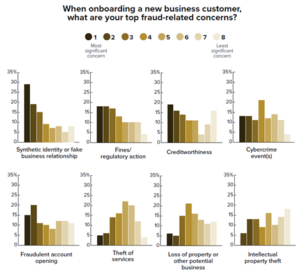

The following chart details survey respondents’ top fraud-related risks and concerns:

While fake identities and false business relationships are employers’ top concerns, 70 percent also note reputational risk challenges that can arise from a new vendor or customer’s controversial business practices. In fact, surveyed businesses consider the imposition of sanctions and involvement in a “high-risk industry or geography” to be more troublesome and detrimental than a potential vendor or customer’s credit history.

Although more than half of surveyed businesses recognize the risks of fraud that can occur when onboarding new vendors (61 percent) and new customers (52 percent), an overwhelming majority (87 percent) believe they have a moderately effective compliance program and processes in place to combat those risks. For example, the most common information businesses collect from vendors and customers is tax ID numbers. The second most common is a vendor or customer’s ownership information (both ID verification of the business owners and ultimate beneficial ownership information), with 81 percent of businesses relying on customer-supplied data and 71 percent using third-party data-service providers. Sanctions screenings are also utilized to identify other potential customer or service-provider malfeasance.

For conducting due diligence on both business customers and vendors, most organizations currently rely on ongoing business account monitoring, adverse media screening and automated sanctions screening, although the frequency of these processes differs based on whether the subject business is a customer or a vendor. Two areas with the most expected growth include artificial intelligence/machine learning and the use of consortium data. While most organizations have yet to start using these approaches, more than 40 percent anticipate adopting them for onboarding new customers and vendors at some point in the future.

Forensic accountants are trained to know the risks associated with both KYV and KYB processes and the effective controls needed to limit those risks and help businesses navigate the minefields of the onboarding process.

About the Author: Richard S. Fechter, CFE, JD, CAMS, is an associate director with Berkowitz Pollack Brant’s Forensic and Advisory Services practice, where he conducts forensic accounting financial investigations and provides expert analysis on the economic, finance and accounting issues related to economic damages and other business matters in complex commercial disputes. He can be reached at the CPA firm’s Miami office at (305) 960-1335 or rfechter@bpbcpa.com.

← Previous